UK IT Sourcing Study 2023

Seeking talent and efficiency, organisations continue to redesign their businesses

With cost pressures rising, talent shortages showing no sign of easing, and organisations seeking to become more sustainable, there’s an intense focus on IT operating models and how the IT function can support the rest of the organisation through these challenges.

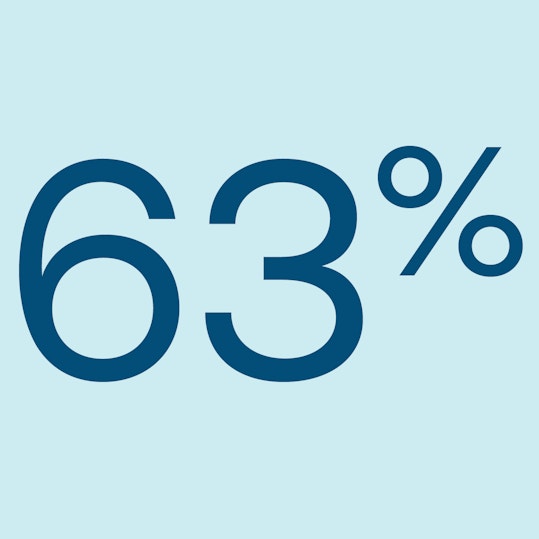

The balance between outsourcing and bringing services in-house is a challenge that IT leaders must weigh up. Our research reveals that the UK sourcing market will grow in 2023, with 63 percent of organisations in the UK planning to outsource at the same rate or more in the next two years. Around a third (30 percent) say they will outsource more. Insourcing intentions continue to remain stable, with 18 percent of respondents planning to continue to insource and build internal capabilities.

About the survey

The 2023 UK IT Sourcing Study, conducted by Whitelane Research in collaboration with PA Consulting, investigates more than 750 unique IT sourcing relationships and 1,440 cloud sourcing relationships held by over 300 participants of the top IT spending organisations in the UK. This makes it one of the largest IT sourcing studies in the UK, and represents a wide market across sectors.

The report uncovers insights into the UK IT sourcing market, highlighting future trends and opportunities for clients and providers in this space.

Key findings from the research

It is clear that organisations are reviewing their sourcing strategies in light of current challenges – access to talent and cost reduction were cited by 57 percent of organisations as their top drivers for outsourcing more.

The balance of insourcing and outsourcing can be difficult for IT leaders looking to maximise value and create efficiencies across their organisations. Almost half (48 percent) said that saving costs was an area of significant interest when it comes to their IT investment priorities, and 58 percent said that they were looking to further automate business processes.

Headwinds in the wider economy mean the need for transformation has never been greater. However, the war for talent continues to be intense, coupled with real and significant cost pressures. This is pushing organisations to rebalance their delivery models, optimise the use of outsourcing and insourcing, and maximise value from the technology investments they have made over the last few years.”

Creating a successful IT sourcing strategy

Successful IT sourcing requires a business to think through not only its sourcing and selection strategy but also the governance capability and maturity required if outsourcing arrangements are to deliver as expected.

Wide discrepancies in this year’s report exist between client and service provider views of the level of governance maturity present within client organisations, with service providers believing clients are over-estimating their capabilities in the key areas of transition, cyber security management, and change management.

1. Understand business needs

Identify any cost and talent pressures that the business is currently experiencing and understand how a balance of out/insourcing, supported by appropriate governance maturity within the client organisation, can help to create and maintain efficiencies and deliver the intended outcomes.

2. Align supplier objectives

Engage with existing and new suppliers, develop an understanding of their objectives, drivers and governance expectations, and revise contracts to include shared incentives.

3. Mature the relationship

Establish clear governance and responsibilities with suppliers, co-create transparent ways of working, and build personal relationships by discussing culture as well as techniques.

4. Drive performance

Identify performance levers and how to use them, establish business analytics, appropriate governance cadence and rigour, and facilitate collaboration between different service providers and business stakeholders.

As new technologies evolve, organisations are keen to identify opportunities to 'do more for less', modernise the existing technology estate, and find ways to decrease reliance on technology resources.”

How we can help

Working to uncover your most complex IT transformation challenges, our experts provide curated solutions to drive innovation and build efficient organisations.

By considering your IT challenges in the context of the wider organisation, our integrated and forward-thinking design approaches build the tech strategy and organisation you need for today – and tomorrow.

- Strategic Sourcing – Helping you create seamless experiences between in-house and sourced services

- IT Strategy and Operating Model Design – Helping your organisation drive business transformation using technology

- Business Performance Transformation – Supporting you to achieve improved performance and sustainable cost reductions

- Cloud and Infrastructure Strategy – Providing insights into cloud transformations, with minimal disruption to your business

- Corporate Shared Services – Designing and delivering ERP solutions, creating shared services operating models designed for success.

Explore more